BY DAN STEINBOCK

BY DAN STEINBOCK

THE PRESSURE toward the diversification of world currency reserves intensified after 2008, escalated following 2022, and is accelerating, as evidenced by the recent BRICS Summit in Kazan, Russia.

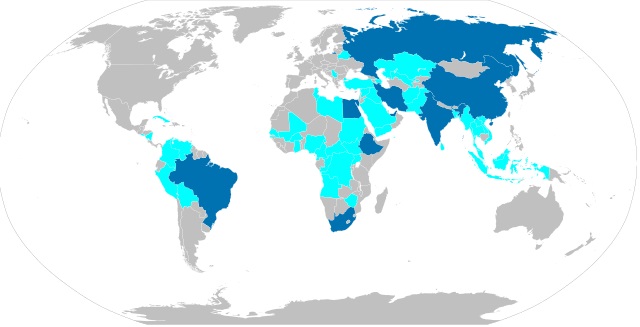

In the past 15 years or so, BRICS has rapidly grown into a geoeconomic front of the Global South. Iran, Egypt, Ethiopia, and the United Arab Emirates attended their first summit as member states in Kazan. Saudi Arabia has been invited to join BRICS. Together, the BRICS members encompass nearly a third of the world’s land surface and almost half of the world’s population.

In September, Turkey officially applied to join the bloc. Numerous countries have expressed interest in joining the BRICS or have already applied for membership in Africa (18 countries), East and Southeast Asia (11), Americas (7), Middle East and Central Asia (8), and Europe (4); that is almost 50 nations.

The BRICS Expansion

Risks of US dollar

Much of world trade remains invoiced and settled in US dollars; many banks based outside the United States nonetheless offer dollar-denominated deposits; many non-U.S. corporations borrow in dollars; central banks hold a large share of their reserves in dollar assets; and so on. The assumption is that, a bit like diamond, the US dollar is forever. In reality, no dominant reserve currency has had an indefinite lifespan.

It is precisely the increasing weaponization of the coercive monopoly of the US dollar – the world’s disproportionate dependency on the US dollar in trade invoicing and settlement, and the dollar reliance by non-US corporate and financial giants, and the dollar’s high share in central banks’ reserves – that increasingly worries not just the Global South, but an increasing number of major economies in the West.

The skeptics say that the dollar has been buried many times before. Why should it die this time? But who says it would have to die? The more, the merrier. Most BRICS economies still rely significantly on the US dollar, whereas those that have been sanctioned by the US and/or its allies have significantly reduced their dollar reserves, often opting for gold instead.

Weaponization of US dollar

When the dollar is weaponized by the US foreign policy in the name of the international community but without the broad support of international consensus, it puts trade invoicing and settlement, foreign corporates, financials, and central bank reserves at risk.

Worse, the weaponization of the US dollar and its complicity facilitates the ongoing genocidal atrocities in the Gaza Strip, where Israel’s actions rely on US arms and financing while turning the rest of the world – even countries that are vehemently protesting such “wars” of obliteration – into co-conspirators of sorts.

The writing is on the wall. Since the creation of the BRICS in July 2009, the value of gold has surged tripling from $953 to almost $2,740 per ounce. It parallels the failure of global recovery and the rise of trade wars since 2017/2018 and the consequent wars and crises.

Gold (USD/t.oz), 2009-2024

Dollar erosion

From a historical point of view, global currency diversification is far from being a new idea. John Maynard Keynes sought even more making the case for a supra-national currency bancor (lit. French banque, “bank gold”) in Bretton Woods in 1944. But the idea was torpedoed by the U.S. negotiators, who wanted to replace the UK pound with the dollar as the world’s major reserve currency.

Keynes cautioned that the dollar primacy would result in great uncertainty and volatility following the reconstruction and recovery of Western Europe and other major economies. That’s what ensued in 1971, when President Nixon ended unilaterally the convertibility of the dollar to gold. As gold no longer offered a yardstick for value, the perception of value replaced value itself. The consequent price shock reverberated across the world.

The twin oil crises were followed by the quadrupling of oil prices, then runaway inflation and stagflation, and eventually record-high US interest rates and massive rearmament drives.

In geopolitics, the U.S. leans on major Western economies and Japan, but the international economy is a different story. As a net consequence, the dollar monopoly contributed to asset bubbles in the 1980s, early ‘90s, early 2000s, and finally in 2008. Amid the Great Recession, China’s central bank governor Zhou Xiaochuan revived the idea and urged major Western economies to “reform the international monetary system.” Then, great pledges were made in Brussels, Washington, and Tokyo, but nothing much happened.

Obviously, the economic architects of the US administrations seek to promote the advantages of the US dollar at the expense of viable alternatives. That’s very much in their economic and geopolitical interest. Similarly, the British, too, touted the blessings of their sterling pound until 1914. But that primacy ended with the overstretch of the UK economy after 1945.

Unfortunately, the United States is on the same trajectory, thanks to record-high debt taking, particularly by the Trump and Biden administrations.

Advantages of diversification

How are the BRICS contributing to diversification? Thanks to their organizational flexibility, the bloc makes possible unilateral, bilateral, and multilateral measures. Analytically, these range from gradual reforms to more unilateral individual measures. The latter, in turn, is driven by the original BRICS founder economies (Brazil, Russia, India, and China), the new aspiring members, and the coalition partners who share the basic BRICS vision and are considering membership as well.

Hence, the efforts at complementary development institutions and critical infrastructure, including the BRICS New Development Bank (NBD), the Asian Infrastructure Investment Bank (AIIB), the Bridge and Road Initiative (BRICS), and the quest for new currency arrangements.

The rising number of populous and large emerging economies makes possible the kind of “network effects” and “positive spillovers” that will be critical to launching the new critical infrastructure for the proposed alternative global financial system.

The goal is not to eliminate the dollar, as the BRICS critics claim particularly in the West. In reality, the BRICS have little to do with rogue states seeking to subvert international order. Rather, like asset managers who seek to maintain appropriate diversification in their portfolios, the BRICS’ objective is to diversify and recalibrate rather than simple de-dollarization.

Global currency arrangements must not reflect just the interests of Americans who account for 4.2 percent of the world population. They must also reflect the aspirations of the multipolar world economy in which global growth prospects are driven by large emerging economies.

________________________________________

Dr. Dan Steinbock is an internationally recognized strategist of the multipolar world and the founder of Difference Group. He has served at India, China, and America Institute (US), Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more, see https://www.differencegroup.net/