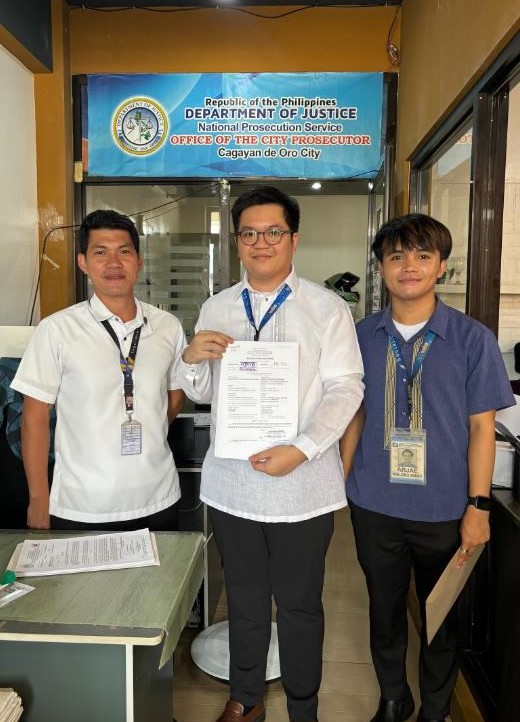

THE SOCIAL Security System (SSS) has filed separate criminal charges at the Prosecutor’s Office against four business establishments for P15 million in unremitted employees’ contributions and penalties as a result of the nationwide Run After Contribution Evaders (RACE) campaigns.

SSS president and Chief Executive Officer Rolando Ledesma Macasaet said SSS is poised to charge another 655 delinquent employers soon for not remitting P257 million workers’ contributions.

Macasaet said that a restaurant business under the name Juanito Galvez, fire extinguisher’s retail-refilling supplier Chedda General Merchandise, BPO service provider e-Telecare, and car spare parts importer Cinwha Trading Corporation deprived their 140 employees of availing SSS benefits or applying for loan programs because of their non-remittance of contributions.

“SSS previously visited the four employers during RACE operations to remind them to pay the contributions of their workers. However, they failed to settle their contribution delinquencies despite receiving violation notices from SSS,” Macasaet said.

Macasaet added the legal actions taken by SSS against these delinquent employers among others only proved that SSS was serious and determined to penalize business establishments who failed to deduct and remit the monthly contributions of their workers.

Renato Jacinto S. Cuisia, SSS vice president for operations Legal Services Division and RACE team coordinator, said that SSS has beefed up its RACE campaigns around the country.

Cuisia said that it issued notices of violation and show cause orders to erring employers compelling them to settle their contribution delinquencies and comply with their obligations under Republic Act No. 11199.

Cuisia added that under the law, employers are mandated to register their businesses with the SSS and report all their employees within 30 days from the actual employment date.

“It is not just a legal obligation, but a moral responsibility of employers to deduct from the employee’s salary the employee’s share in the monthly SSS contribution and, together with the employer’s share, remit it to the SSS,” Cuisia stressed.

Based on the SSS assessment, Cuisia said restaurant owner Juanito Galvez had the highest contribution delinquency among the four delinquent employers, with P11.1 million composed of P4.8 million unpaid workers’ contributions and P6.4 million penalties.

Cuisia noted that SSS records showed that the establishment still needed to remit the SSS contributions of its 35 employees from June 2007 to August 2023.

He said that the restaurant owner and the three other erring employers were given multiple opportunities to settle their contribution delinquencies. “However, they did not cooperate with the SSS and comply with the Social Security Law, leaving SSS with no other recourse but to file a case in court against them,” he explained.

Earlier, SSS issued violation notices to more than 1,200 delinquent employers across the country in a synchronous RACE operation to remind them of the legal consequences of not remitting their employees’ contributions.