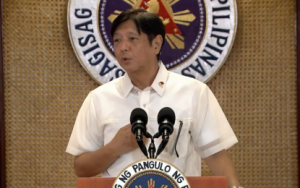

MANILA – President Ferdinand R. Marcos Jr. has ordered to hasten the digitalization of the Philippine Identification (PhilID) system to ensure the cardholders’ seamless transactions with the public and private sectors, Malacañang said on Friday.

Marcos gave the directive during his meeting with the members of the Private Sector Advisory Council (PSAC) on Digital Infrastructure at Malacañan Palace in Manila on Thursday, according to Presidential Communications Office Secretary Cheloy Garafil in a statement.

“President Ferdinand R. Marcos Jr. issued a directive Thursday to speed up the digitalization of the National Identification (ID) system that could be used for public and private transactions,” Garafil said.

The Philippine Statistics Authority’s (PSA) proposed public-private partnership (PPP) for the launching of the digital PhilID application is one of the topics raised during Marcos’ meeting with the PSAC, Garafil said.

“Naiwanan na tayo sa technology (We are lagging behind in terms of technology), so we have to catch up.” Marcos was quoted as saying.

Marcos, Garafil said, emphasized the importance of a digital PhilID system, considering that it would be “easier to upgrade and implement” the use of the national IDs.

“During the discussion, President Marcos asked the private sector to help get the National ID out, noting it has the technology and capability for new digital IDs,” she said.

“The benefits of adopting a digital ID system include automated eKYC (Know Your Customer), identity theft protection, credit card and loan applications, and digital wallet,” Garafil added.

Under Republic Act (RA) 11055 or the Philippine Identification System (PhilSys) Act, the PhilID should be accepted and recognized in government and private transactions, and shall be considered as an official and sufficient valid proof of identity for all Filipino citizens and resident aliens.

The Philippine Statistics Authority (PSA), the implementing agency responsible for the overall planning, management and administration of the PhilSys, is targeting the launch of the mobile PhilID app by the first quarter of 2023 with the assistance of the private sector.

Garafil said submission of government records, digital signature use and incorporation of identity to government agencies are among the benefits of having a digital ID system.

This, as she noted the successful use of digital ID globally include “system integration, ePrescription, online banking, transportation solution, personal information reference, application for government documents and face verification.”

Garafil said the digital ID integration to a digital wallet would help eliminate long lines in Assistance to Individuals in Crisis Situations (AICS) distribution, and support the government’s anti-fraud and anti-scamming efforts.

She added that the digitalization of PhilID would facilitate the faster disbursement of government cash aid and improved monitoring of the Department of Social Welfare and Development programs.

“The valid proof of ID by PhilSys is expected to simplify public and private transactions and become a social and economic platform that promotes seamless social service delivery and strengthen financial inclusion for both public and private services,” Garafil said.

“PhilSys is seen to transform how services are delivered in the Philippines and is expected to accelerate the country’s transition into a digital economy, including enabling presenceless, paperless and cashless transactions,” she added.

Citing a study by the Mckinsey Global Institute, Garafil said the implementation of a digital ID program to an emerging economy with high adoption rates can unlock an economic value of up to an additional three percent of the gross domestic product (GDP) by 2025, which is equivalent to PHP700 billion.

The digital use of PhilIDs will also entail an additional 6 percent of the GDP by 2030 or PHP1.8 trillion, Garafil said.

“The sources of value for the increase in GDP include increased use of financial services, improved access to employment, increased productivity from time saved, reduced costs for government and institutions, higher tax participation leading to higher collections, and increased access and participation from rural farmers,” she said. (PNA)