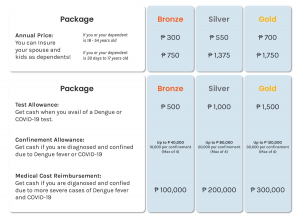

With its partnership with Singlife, GCash is offering a free COVID-19 insurance via its GInsure marketplace for as low as PHP 300. The coverage entitles the holder protection against and dengue with a PHP 140,500 benefit.

Enrolment to the service can be easily done within a few minutes inside the GCash app. A customer should just log-in to the app, tap the GInsure icon, and select the COVID-19 and dengue coverage from Singlife.

“Protecting one’s self during the pandemic is an imperative, not only for ourselves, but also for those who are depending on us. One way of doing so is by maximizing the technology of GCash and what it has to offer, such as insuring ourselves via GInsure”, said Martha Sazon, President and CEO of GCash. “We have been in this situation before, but we are now in a better position to fight it,” she added, referring to the pandemic.

Aside from insuring themselves against the pandemic through GInsure, Filipinos can also maximize GCash to pay cashless via its Pay Bills, Send Money, and Scan QR features, protecting them from physical contact and allowing them to do financial transactions at the comfort of their homes.

Introduced just last year, GInsure is an insurance marketplace service available in GCash that lets customers purchase preferred insurance products with very competitive offerings. GInsure currently features insurance products from globally-trusted insurance brands, such as Singlife.

Singlife products are available via GInsure on the GCash app. For more information, visit go.gcash.com/39nnQ3Q

Globe Fintech Innovations Inc. (Mynt), which operates GCash, is part of the portfolio companies of 917Ventures, the largest corporate incubator in the Philippines wholly-owned by Globe Telecom Inc.

GCash is available for download on the App Store, Google Play, and App Gallery. For more information, kindly visit https://www.gcash.com/.