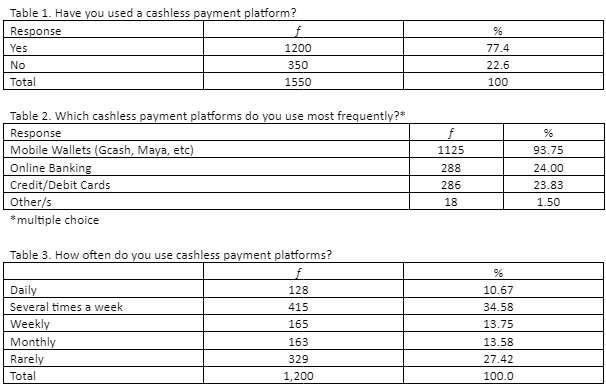

NEARLY 8 in 10 Davaoeños use cashless payment apps, particularly e-wallets, multiple times a week, according to the latest survey of the University of Mindanao Institute of Popular Opinion (UM -IPO).

The survey, conducted from Dec. 5 to 25, 2024, asked 1,550 respondents “to know their opinion on the effects, benefits, and disadvantages of using cashless payment platforms.”

The survey said that 9 in 10 use mobile wallets (Gcash, Maya, etc.) for their transactions. “Online banking (24.0%) and debit/credit cards (23.83%) were also utilized but to a lesser extent,” the report said.

When asked in terms of usage frequency, 3 in 10 (34.58%) used cashless payment platforms several times a week, 3 in 10 (27.42%) used them rarely, while the rest used them weekly (13.75%), monthly (13.58%) and daily (10.67%).

In terms of usage patterns and preferences, 6 out of 10 (64.58%) Davaoeños used cashless payments for online shopping, 6 out of 10 (57.33%) used for bill payments, 5 out of 10 (47.17%) used them for groceries, and 4 out of 10 (41.67%) used them for dining out. Other notable uses included transportation, tuition fees, and mobile load top-ups.

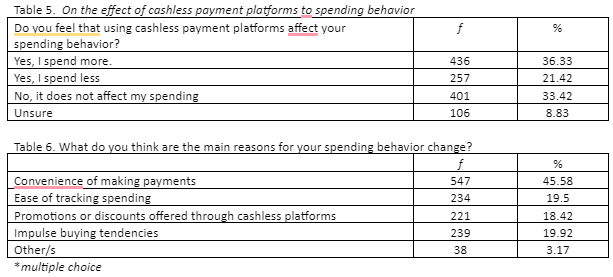

When asked about the impact of cashless payments on spending habits, a divided response was obtained. 4 out of 10 (36.33%) Davaoeños stated that they spend more due to ease of transactions, while 2 out of 10 (21.42%) indicated that they spend less likely due to better tracking tools; meanwhile, 3 out of 10 (33.02%) saw no impact on their spending behavior and 1 out of 10 (18.83%) was unsure. On the other hand, the primary factors influencing changes in spending habits were convenience (45.58%), impulse buying (19.92%), and promotional discounts (18.42%).

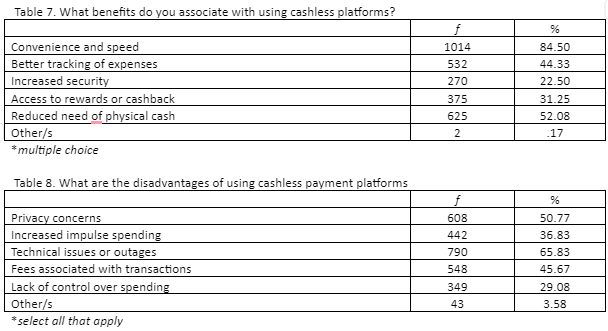

Finally, we asked the respondents about the benefits and disadvantages of cashless payment platforms. Regarding benefits, 8 out of 10 (84.50%) Davaoeños stated that these platforms offer convenience and speed, while 5 out of 10 (52.08%) highlighted the reduced need for physical cash. Additionally, 4 out of 10 (44.33%) agreed that cashless payment platforms enhance expense tracking. On the other hand, respondents also recognized potential disadvantages, with 7 out of 10 (65.83%) Davaoeñosreporting experiencing technical issues or outages. Privacy concerns were raised by 5 out of 10 (50.77%) respondents, while the presence of transaction fees was noted by 5 out of 10 (45.67%). Furthermore, 4 out of 10 (36.83%) acknowledged that these platforms could contribute to increased impulse spending among consumers.

Since the survey was done online, IPO relied heavily on online, pre-defined, targeted social media users who met the inclusion criteria. The survey was disseminated via sponsored ads on two Meta platforms (Facebook and Instagram). Respondents were defined to be at least 18 years old, targeted for contact within the defined geographical radius, have valid/active email addresses, and have utilized any cashless payment platform. The survey was done at a 95% confidence level and a 3% margin of error. Three (3) questions were asked to cover issues such as the nature and frequency of usage, the effect on one’s spending behavior, and the benefits and disadvantages of using cashless platforms.

Cashless payment platforms have become popular among the Davaoeños. Because of the new and growing technology, its use has become easy and convenient. While this technology comes with benefits, there may be downsides to it too. So it is always good to be prudent in its use.